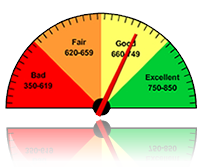

Prospective clients often

ask how their actions will impact their credit score, that three digit

number between 300 and 850 that is supposed to reflect your credit

worthiness. Much of what makes up the credit score is deliberately kept secret by

the privately held corporation (Fair Isaac Corporation) that started

developing credit scores in the 1950s. The three credit bureaus

(Equifax, Experian, TransUnion) and individual creditors may also have

different scores because they use a different credit score model or

because not all creditors report to the same bureaus. But we know

generally that the FICO score created by Fair Isaac is made up of the

following factors; (1) 35% of the score is based on your payment

history, e.g. late payments, the length of time since something negative

occurred, the number of delinquencies and the number of negative public

records regarding debt; (2) 30% of the score is based on the ratio of

credit used to the credit available, e.g. how close are you to the

maximums on credit cards and the number of open credit accounts; (3) 15%

of the score is based on the length of your credit history including

how long accounts have been opened; (4) 10% of the score is based on new

credit, e.g. how many new accounts have been opened or applied for

recently, possibly meaning an overextension of debt; and (5) 10% of the

score is based on the mix of accounts, e.g. a variety of different

accounts like a mortgage, car loan and revolving credit card accounts.

|

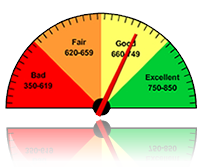

Thankfully there are efforts underway to restrict how credit scores can be used.

Evidence suggests that credit score models discriminate against

minorities and the poor. Several states have also passed or are

considering legislation prohibiting credit scores from being used in

employment, insurance and other situations. And some people are

rejecting America's credit score obsession altogether by eliminating all

or most of their debt. By paying cash for everything they've ruined

their credit score but freed themselves from the constant worry about

how bills will be paid.

|